Learning how to create a simple budget in a few straightforward steps has saved our family so many times from financial emergency and a debt-filled life. Follow along to see how we did it!

When my husband and I first got married, and especially when we had our first child, money was extremely tight. I was not working a lot (or at all while on maternity leave), and my husband was making minimum wage.

We knew that we wanted one parent home at least part-time to keep up the house and be more available for the kids, but that it would mean some financial sacrifices. We were determined, however, not to let our tiny income result in mounds and mounds of debt that we would carry with us into our future.

The only way to keep that from happening was to create a budget.

Yup. The dreaded “B” word.

But for real. I actually love the “B” word. It has consistently kept us out of debt, kept our spending in check, and provided a way for us to track and reach our financial goals.

Sure we have high periods and low periods (ie job loss, unforeseen expenses, etc.), but our budget has helped us keep our footing through all of it to reduce financial emergencies and spend/save our gains wisely.

Why is it so important to create a budget?

Budgets are so important, whether you make a teeny tiny pay cheque or a big fat pay cheque.

Oftentimes, people who make the most money end up in the biggest debt. This is because their spending isn’t being managed, and they are often trying to maintain a particular lifestyle that they may not be able to afford…

People on low incomes really need a budget to not only keep track of expenses, but also to keep up motivation, as a guide to help them reach their goals and keep debt at bay.

So how do I create a budget?

Oh, I’m so glad you asked 😉

Ok, I’m going to break this up into a series of steps, and go through each one. Stick with me, okay? It’s basically making sure that you earn more than you spend.

So grab a cup of tea, your favourite pen, and let’s get started 🙂

Step 1: Calculate your total monthly income

To start: I am considering a month to be every 4 weeks. This keeps things consistent, even when there is a 5 week month. You have the same amount to spend every 4 weeks. More on this later…

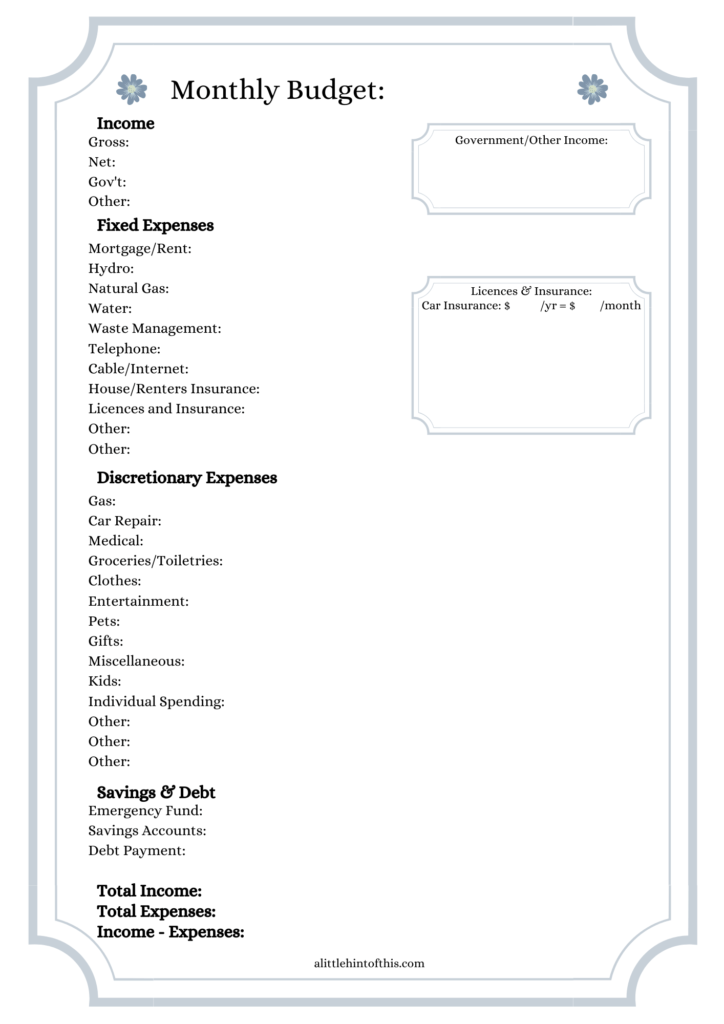

I list both my gross (before deductions) and net incomes (after deductions) on my budget. It helps give me an idea of taxes, etc. However, it is your net income that you will really be working with here.

Your income should also include any money from the government, child support, spousal support, rental income etc. All income that comes into your home should be listed as monthly income! (I put a box to the side on my template where I calculate all the government income. In Ontario, it is often broken down into a few different amounts. Do what works for you where you live 🙂 )

Step 2: Write down your fixed monthly expenses

This will include any expenses that you must pay every month/year. It will include things like:

- Mortgage/rent

- Utilities (water/hydro/gas)

- Communications (phone/internet/Netflix etc)

- Licenses and registrations (I also have a box on my template to calculate all of these expenses as one)

- Insurance (house/car/renter’s etc)

Step 3: Write down your discretionary expenses

These are things that you have some flex in how much you spend. For my family, I break these into categories including:

- groceries/toiletries

- pet (food, vet bills, toys, etc)

- clothing

- gifts

- miscellaneous

- gas

- car repairs

- entertainment

- medical (for anything not covered by benefits/insurance)

- individual spending money

- kids (extracurriculars, events, etc)

If you have no idea how much you spend on these items each month, go through bank and credit card statements for the last 4 months. Divide what you spent into each of these categories. It should help give you more of a range.

Step 4: Enter this information into your budget template

I’ve included a simple budget template for you to use. Of course you can just use any paper and use the categories that work for you, but this free printable How To Create A Simple Budget template will save you some time 😉

Step 5: Subtract all of your fixed and discretionary expenses from your income.

If you are left with a positive number, congratulations! You have some money to begin saving and paying off debt with. You will add these categories to your budget to begin paying down debt and growing your wealth 🙂

If your total is $0, you are just breaking even. This is okay short-term, but very risky, as you don’t have money left for savings, debt payments, or unexpected expenses. You are living pay cheque to pay cheque. But don’t worry, you’re not going to be for long!

If you are left with a negative number, you are going to need to readjust your budget. This negative number means you are overspending every month, and getting more and more in debt.

In order to survive and thrive, your income must be higher than your expenses!!

There are 2 ways to make this happen: spend less or earn more.

Spend Less: Go back to your budget and play around with your expenses until you reach a positive balance on your total. This could mean reducing your television expenses, or eating out less, for example. Anywhere that you can trim spending, go for it.

Here, you can start playing around with your discretionary expenses. What is an amount that works for you each month for gifts? Could you do $30 a month? Maybe you have a small family and not a lot of ‘gifting events’ and could pull off $20 a month?

What about food? How much do you need for your family each month?

Costs can often be reduced here by cooking from scratch and using seasonal ingredients. In our house we do one big grocery shop each month to help make bulk items more affordable and reduce impulse spending.

Earn more: means exactly that. Is there a side hustle you can do? Perhaps some extra hours at work, or inquiring about a raise? You can get really creative once motivated to get out of debt and get a reign on your finances:)

How to calculate for 4 weeks instead of a month

Some months are 4 weeks, some are 5. In order to keep things even, I calculate everything to be for a 4 week rotation (I just call it a month for ease). Here’s the basic math to do it (don’t worry, I stink at math, so I keep things simple):

If you make $50 000 (net) a year, divide that by 52 weeks ($50 000/52 = $961.54 per week). Then multiply that weekly income by 4 ($961.54 x 4 = $3846.15). That number is your net income every 4 weeks.

Likewise, if you know that you pay $200 a year for driver’s licence fees, divide that by 52, then multiply by 4 to get your ‘monthly’ cost ($200/52 = $3.85. $3.85 x 4 = $15.38 per ‘month’ for driver’s licence fees)

What about monthly bills? Those I just leave as they are, and pay them per month. I budget a certain amount each month to cover them.

So, now that I have a budget, what do I do?

Okay, so you now know about where you stand financially. You can see on paper where your hard-earned dollars are wandering off to. You can see where maybe you are spending more than you need to be.

The trick is to stick to your budget. For us, this means going through the budget each week to pay off bills, check in on spending, make debt payments, etc.

Yes, this will be difficult. Especially if you have some…strong…spending habits 🙂 Living on what you make will be an adjustment for many.

But the reward of doing it is wonderful. Knowing you are getting in control of your money, instead of it controlling you, is a freeing feeling. Trust me.

Pin it for later

So What’s Next?

Check out my other posts on back-to-basics finances for all the steps, hints, and guides to pay down debt and gain financial freedom 🙂

Also, sign up below to be the first to receive all new posts from A Little Hint of This directly to your inbox!

Thanks for stopping by!

Leave a Reply